Nifty and Bank Nifty Analysis for 9th July 2020

Bank Nifty opened on a positive note and witnessed a strong momentum towards the 23,000 mark. However, it drifted from higher levels and wiped out all the intraday gains to close flat as the follow-up buying was missing at higher levels.

Nifty opened positive and headed towards the 10,850 mark. However, it failed to hold its morning gains and drifted sharply towards the previous day’s low at 10,689 level before closing the session with a loss of around 100 points.

Let’s check the data and do the analysis for Bank Nifty and Nifty for 9th July 2020 based on Open Interest, Change in OI, PCR, Max pain and Trend Cycles.

Bank Nifty Option Front

Bank Nifty has given closing at 22584.55 on spot on 8th July 2020. On the options front, maximum Put open interest was at 22,000 followed by 21,000 levels, while maximum Call OI was at 23,500 followed by 23,000 levels. The OI positions are scattered at various strike rates, indicates the volatility can remain in the market. A good put addition has been seen around the ATM strike.

Trading Range Of Bank Nifty

Now time to find out the trading range of the bank nifty. Trading Range is a general range between the highest call strike and highest put strike. To find the range, we need to look for the highest call OI Row and Highest Put OI Row on the option chain of the Bank Nifty. Trading range seems to be 21500 to 23500.

1. Highest Call at 23,500.

2. Highest Put at 22,000.

3. Pivot Level at 22,500.

Highest call acts as the highest resistance and highest put acts as the highest support for the Nifty and bank nifty. Pivot level is the level that bulls and bears don’t want to let it go easily. Tug of the war goes around the pivot level between bulls and bears generally.

Trading Range Of Nifty

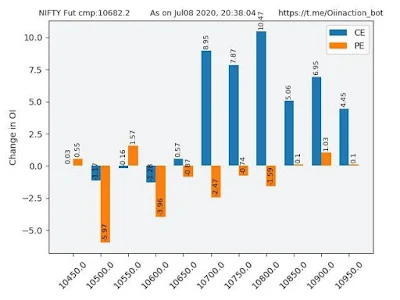

Nifty has given closing at 10705.75 at spot on 8th July, 2020. In options front, maximum Put open interest stood at 10,600 level followed by 10,300, while maximum Call OI was at 11,000 followed by 10,800 levels. Call addition was seen at 10,800 followed by 10,700 levels, while there was meaningful Put unwinding at 10,500 followed by 10,500 levels. Options data suggested a shift in trading range between 10,600 and 10,800 levels.

1. Highest Call at 11000.

2. Highest Put at 10,600.

3. Pivot Level at 10,700.

3. Pivot Level at 10,700.

India Vix

India VIX moved up 3.98 per cent to 26.10 level. Volatility rose after a decline in the last five sessions, but overall lower volatility suggested a bullish stance. It is sustaining above the maximum on Box Plot into outlier data on the daily scale and thus volatile swings may continue in the coming days. If you wonder what Box Plot is and how it works, you can check here details.

Derivative Data

Symbol

|

Pre. Max Pain

|

PCR (OI)

| |

Bank Nifty

|

22500

|

22300

|

0.95

|

Nifty

|

10700

|

10700

|

1.36

|

Remarks

| |||

Trend Cycles (EOD)

| Nifty Trend Cycles |

Conclusion

The unwinding in the put side has been seen, indicates the bulls are escaping and support is getting weak. However; the writers are still available in huge quantity in both side so we cannot strike off the volatile swing in the market. On the trend cycles, Bank nifty is showing long-long cycles whereas Nifty is in Long-long unwinding cycles.

Open Interest Images are generated by the Telegram Bot: OIinAction. You can also join it and can generate OI images for free.

Disclaimer: The analysis has been prepared for informational and educational purposes only. It is not and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Recommended Read:

No comments: