Mastering Intraday Trading in Nifty and Bank Nifty with Option Chain

Intraday trading in the Indian stock market has emerged as a dynamic opportunity for traders to capitalize on short-term price movements within major indices like Bank Nifty and Nifty. This popular trading strategy necessitates a profound comprehension of market dynamics, technical indicators, and astute risk management.

Open Interest (OI) is a crucial concept within the realm of options trading. It represents the total number of outstanding or open contracts for a specific option strike price. In other words, it's the total number of contracts that have been initiated by traders but have not yet been closed out or offset by an opposing trade.

For example, if a trader purchases a call option contract, it adds to the open interest. If another trader sells a call option contract, an equal and opposite position is created, and the open interest remains unchanged. Open interest is not affected by the buying or selling of options between individual traders, but rather by the creation of new positions.

Here's a breakdown of how open interest works:

Opening a Position: When a trader initiates a new options contract (either by buying a call or put option), it contributes to the open interest.

Closing a Position: When a trader who holds an open options contract decides to sell or buy back the same contract, the open interest for that contract decreases. Essentially, closing a position reduces open interest.

No Impact from Offsetting Trades: If one trader sells an options contract and another trader buys the same contract, these two opposing trades do not affect the open interest. The open interest remains the same until new contracts are created or existing contracts are closed.

New Positions: When traders initiate new positions (either by opening new contracts or buying to close existing contracts), the open interest increases.

Open interest is a key metric used by traders and analysts to gauge market sentiment and potential price trends. Higher open interest can indicate increased liquidity and interest in a particular strike price, suggesting greater market participation and potential price movements. Conversely, declining open interest may suggest waning interest in a particular option and could signal a potential decrease in price volatility.

Intriguingly, Open Interest data becomes the linchpin in designating pivotal support and resistance levels on the option chain. Visualizing the Nifty 50 Option Chain, a color-coded representation guides us:

Crucially, the volume of open interest aligns with the gravity of support or resistance at a specific strike price.

Different trends come to light, revealing the sentiments of various participants:

In conclusion, mastering intraday trading demands a fusion of knowledge, strategy, and informed decision-making. The option chain emerges as a potent tool, unlocking layers of insights for traders to navigate the complexities of the Indian stock market. Elevate your intraday trading journey by harnessing the potential of the Option Chain Analysis.

Remember, the path to success in intraday trading is illuminated by continuous learning and diligent application.

A strategy gaining prominence in this realm is the meticulous analysis of the Option Chain. In this blog post, we will unravel the intricate process of deciphering the Nifty Option Chain and Bank Nifty Option Chain for intraday trading.

Option Chain Analysis: Nifty & Bank Nifty

Before Delving into the strategy, first understand Open Interest that will play an important role in this.

Open Interest (OI) is a crucial concept within the realm of options trading. It represents the total number of outstanding or open contracts for a specific option strike price. In other words, it's the total number of contracts that have been initiated by traders but have not yet been closed out or offset by an opposing trade.

For example, if a trader purchases a call option contract, it adds to the open interest. If another trader sells a call option contract, an equal and opposite position is created, and the open interest remains unchanged. Open interest is not affected by the buying or selling of options between individual traders, but rather by the creation of new positions.

Here's a breakdown of how open interest works:

Opening a Position: When a trader initiates a new options contract (either by buying a call or put option), it contributes to the open interest.

Closing a Position: When a trader who holds an open options contract decides to sell or buy back the same contract, the open interest for that contract decreases. Essentially, closing a position reduces open interest.

No Impact from Offsetting Trades: If one trader sells an options contract and another trader buys the same contract, these two opposing trades do not affect the open interest. The open interest remains the same until new contracts are created or existing contracts are closed.

New Positions: When traders initiate new positions (either by opening new contracts or buying to close existing contracts), the open interest increases.

Open interest is a key metric used by traders and analysts to gauge market sentiment and potential price trends. Higher open interest can indicate increased liquidity and interest in a particular strike price, suggesting greater market participation and potential price movements. Conversely, declining open interest may suggest waning interest in a particular option and could signal a potential decrease in price volatility.

Understanding the Foundation: Support and Resistance Levels

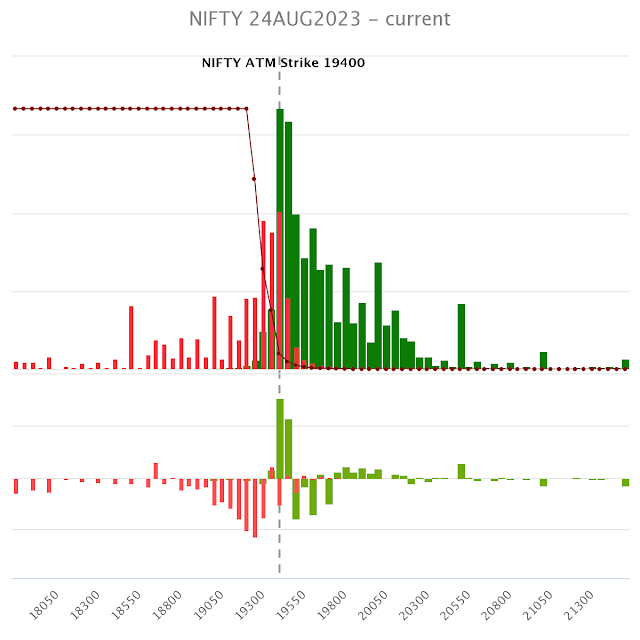

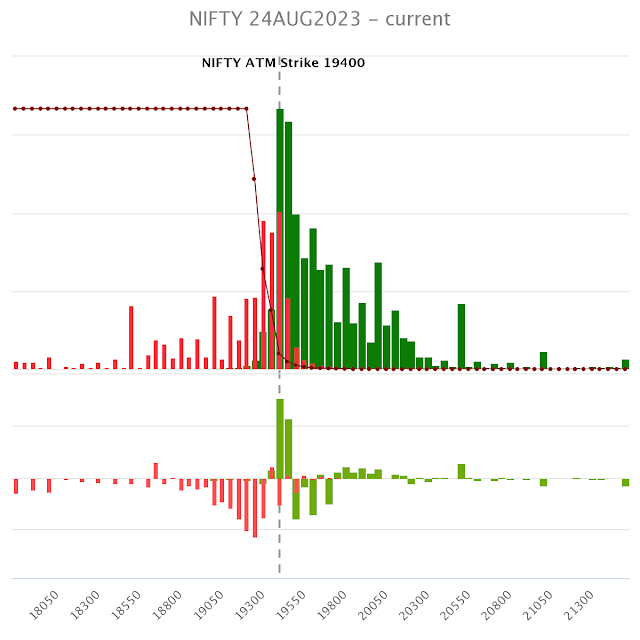

At the core of successful intraday trading lies a thorough understanding of support and resistance levels. The option chain, a treasure trove of information, is divided into two distinctive sections: Call and Put. On the Call side, strike prices inherently pose as resistance levels, while on the flip side, support levels come to light.Intriguingly, Open Interest data becomes the linchpin in designating pivotal support and resistance levels on the option chain. Visualizing the Nifty 50 Option Chain, a color-coded representation guides us:

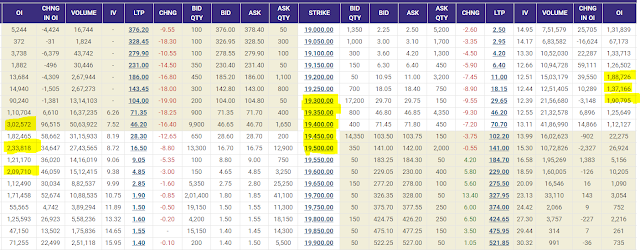

- Yellow Painted Call Open Interest (OI) and corresponding Strikes signify Resistance.

- Yellow Highlighted Put Open Interest (OI) and corresponding Strikes indicate Support.

Crucially, the volume of open interest aligns with the gravity of support or resistance at a specific strike price.

Illustrative Insight: The Logic of Support and Resistance

Let's exemplify the concept. Consider strikes 19400 and 19500. Strike 19400 boasts around 3 lakh lots of Open Interest Positions, while Strike 19500 exhibits approximately 2.33 lakh lots of Open Interest positions. Evidently, 19400 emerges as a stronghold of resistance in contrast to 19500. This logical correlation empowers traders to navigate the option chain effectively.Deciphering Trading Ranges and Pivot Strikes

Moving forward, the strategy unfolds with the deciphering of trading ranges. These ranges unveil transient movements expected within the Nifty. A trading range materializes as the expanse between the highest call strike and the highest put strike. Embedded within this range is a pivotal strike, a gateway to informed entry decisions.The Power of the Pivot Strike

The pivotal strike acquires profound significance. It manifests as a strike where Open Interest positions on both call and put sides converge harmoniously. This equilibrium serves as a battleground where bullish and bearish forces vie for supremacy. The outcome shapes the forthcoming market movement. Illustrated in the image is the strike 19350, a potential pivot. Sustenance above this level indicates a bullish trajectory, while a breach may signal bearishness.Unveiling Market Trends through Option Chain Analysis

To unravel the intricate tapestry of market trends, the synthesis of Open Interest and the Change in Last Traded Price (LTP) column emerges as the guiding star. This synthesis unveils the precise identities of buyers and sellers within the option chain.Different trends come to light, revealing the sentiments of various participants:

- Call Buyers + Put Writers = Strong Bullish Sentiment

- Call Sellers + Put Writers = Strong Bearish Sentiment

- Call Buyers + Put Unwinding = Bullish Sentiment

- Put Buyers + Call Unwinding = Bearish Sentiment

In conclusion, mastering intraday trading demands a fusion of knowledge, strategy, and informed decision-making. The option chain emerges as a potent tool, unlocking layers of insights for traders to navigate the complexities of the Indian stock market. Elevate your intraday trading journey by harnessing the potential of the Option Chain Analysis.

Remember, the path to success in intraday trading is illuminated by continuous learning and diligent application.

(Note: The information provided here is for educational purposes only and should not be considered as financial advice. Trading in the stock market involves risk and requires careful consideration of individual circumstances.)

No comments: