Maximize your profit with OI Spurts Strategy

Are you tired of your trading strategy being stuck in a rut? It's time to revamp it with the OI Spurts Strategy! If you've been searching for a dynamic and efficient approach to supercharge your profits, you've come to the right spot.

In this post, we'll guide you through how this innovative OI Spurts Trading strategy can elevate your trading game to new heights. We will delve into every aspect of OI spurts, encompassing its meaning, applications, effects, and influence on stocks.

The What and Why of OI Spurts Strategy

Let's start by unraveling the OI Spurts Strategy and understanding why it deserves your consideration. OI stands for Open Interest, and this strategy is your ticket to unlocking the potential of options trading, especially when guided by surging open interest. Think of it as supercharging your trading vehicle for an exhilarating ride! Wondering why it's worth your attention? Let's dive in.

OI Spurts Meaning simplified for Beginners

An OI or open interest spurts in stock trading signifies a sudden uptick in the number of open contracts or positions tied to a specific stock. This surge can be triggered by various factors, including an influx of new buyers or sellers, shifts in market sentiment, or impactful news events affecting the stock.

When open interest increases, it typically reflects heightened trading activity and improved liquidity within the stock. This can be seen as a favorable signal for traders and investors, as it suggests a more vibrant market. Nonetheless, it's essential to be aware that this surge can also introduce greater volatility and risk. With more participants entering the market, it becomes more susceptible to significant price fluctuations.

Why I Consider OI Spurts in my Day to day Trading?

As mentioned earlier, OI Spurts serve as a valuable indicator of a stock's liquidity. The greater the shift in open interest, the more liquid the stock becomes. This enhanced liquidity facilitates quicker trade execution, a key advantage for traders. Personally, I find this method to be the most effective means of identifying momentum stocks, enabling me to capitalize on sudden price movements during my intraday trading endeavors.

Getting Started with OI Spurts Strategy

I rely on OI Spurts to pick stocks for my momentum trading, whether it's for intraday or swing trading. To do this, a visit to the NSE OI Spurts page is necessary. This page provides a real-time listing of all stocks experiencing abrupt shifts in Open Interest, making it a valuable resource for traders.

|

| NSE OI Spurts |

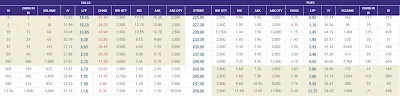

Take a look at the image above; it's a table featuring various columns, including Symbol, Open Interest (Current Day), Open Interest (Previous Day), Change in OI, % Change in OI, Volume, and Future Value.

The Symbol column represents all the active scrips, which include a combination of indices and stocks. Among the active indices are Finnifty, Midcap Nifty, Nifty, and Bank Nifty. On the other hand, active stocks such as Syngene, LTTS, ABB, Biocon, and Cipla are part of this list.

In this post, we'll focus on stocks since that's our topic of discussion.

The % Change in OI column plays a pivotal role in stock selection. I scan this column and identify stocks with a more than 30% change in Open Interest. These stocks tend to be in a state of momentum or are poised for it. Consequently, stocks like Syngene, LTTS, ABB, and Biocon are under consideration for our trades.

It's essential to understand that an open interest spurts, by itself, doesn't predict whether a stock's price will rise or fall. It simply helps identify where momentum is building. To make a well-informed analysis, you should also consider various other factors, including market trends, OI Build Ups, Option Chain and OI analysis, as well as technical analysis.

OI Spurts Strategy in Action

Now, let's explore how the OI Spurts Strategy can revolutionize your trading approach. To illustrate this, consider a real-life scenario:

Imagine you're intrigued by Biocon, one of the stocks from our previously mentioned list. In this case, we'll delve into its Option Chain and Open Interest Build Ups to pinpoint support, resistance, and the prevailing trend. As an Option Chain and Open Interest analyst, I find immense pleasure in dissecting these datasets for insightful analysis.

Also Read : Exploring the Option Chain: A Beginner's Guide

Here we have the Biocon Option Chain, a valuable tool for analysis. By studying this option chain, we've identified that 245 and 250 serve as strong resistance levels, while 240, 235, and 230 emerge as robust support levels. Notably, 240 stands out as a critical support level.

Now, you might wonder how to pinpoint these levels effectively. This post holds the answers.

In essence, Biocon's trading range is defined between 230 and 250, with 240 playing a pivotal role as a potential maker or breaker. In the world of option chains, it's the option sellers who steer the market's direction. If your keen eye can discern the activities of sellers and buyers within the option chain, you can navigate the market alongside the smart money.

OI Spurts and OI Build Ups

Our approach to option chain analysis revolves around the viewpoint of option writers or sellers. However, by delving into the details of Open Interest Build Ups, one can effectively identify the activities of both option buyers and sellers. Let's take a look at the image below for a clearer picture:

|

| Biocon OI Buildups |

In this image, we're presented with a snapshot of the Open Interest build-ups across various strike prices. The color code used is quite intuitive: deep green highlights Long Build Ups, red signifies Short Build Ups, while light green and orange indicate Short Covering and Long Unwinding, respectively.

On the put side, we observe both Long Build Ups and Short Covering. This suggests that investors are showing a keen interest in buying put options, while those who had initially shorted put options are now closing their positions to mitigate potential losses. This situation points to a sense of panic among put writers.

Conversely, on the call side, we see a scenario where call writing is taking place alongside Long Unwinding. This indicates a state of unease among call buyers.

When we blend these various build-ups together, it becomes evident that Biocon appears considerably weak when analyzed from a data perspective.

Examining the Biocon chart above, it becomes evident that 240 holds significant importance as a crucial support level. Should this level be breached, it's likely to trigger a notable decline in its price.

The meaning of OI spurts and how it differs from volume spurts

OI Spurts and Volume Spurts are distinct concepts in stock trading, even though they may occasionally intersect.

Open Interest (OI) Spurts: Open interest is the total number of active contracts or positions in a specific stock or derivative instrument. An OI spurt takes place when there is a sudden and substantial increase in the number of open contracts.

This surge signifies the creation of new positions, either from fresh buyers entering the market or existing traders expanding their holdings. An OI spurt typically signals heightened trading activity and increased liquidity in the stock or derivative.

Volume Spurt: In contrast, volume refers to the overall number of shares or contracts traded within a specified timeframe, such as a day or an hour. A volume spurt occurs when there's an abrupt and significant surge in trading volume.

This surge indicates that a substantial number of shares or contracts are being bought or sold during that specific period. A volume spurt underscores heightened market activity and often corresponds to increased interest and participation from traders and investors.

The methods for analyzing OI spurts and Volume spurts may vary, but both serve as effective indicators of liquidity.

In conclusion, the OI Spurts Strategy is a powerful tool for traders looking to revamp their trading approach and unlock the potential of options trading. Open Interest (OI) spurts can be a game-changer, providing valuable insights into stock liquidity and momentum.

Frequently asked questions (FAQs) for the NSE OI Spurts and OI Spurts Strategy

What is the OI Spurts Strategy, and how can it benefit my trading?

The OI Spurts Strategy is a method of analyzing open interest (OI) in stock trading. It can help traders identify potential stock movements and trading opportunities, allowing them to make more informed decisions to maximize profits.

Why is open interest (OI) important in trading?

Open interest reflects the number of active contracts or positions in a stock or derivative instrument. It's crucial because it indicates the level of market activity and liquidity, providing insights into trading sentiment and potential price movements.

How do I use the OI Spurts Strategy to select stocks?

The strategy involves monitoring OI Spurts by visiting platforms like the NSE OI Spurts page. You can focus on stocks showing significant changes in open interest (typically more than 30%) as they often represent momentum stocks with trading potential.

What is the significance of the % Change in OI column in stock selection?

The % Change in OI column plays a pivotal role in identifying potential trading opportunities. A significant increase in open interest can suggest a surge in trading activity and momentum in a stock, making it a prime candidate for trading.

How do I analyze option chains and open interest build-ups to make informed trading decisions?

Analyzing option chains and open interest build-ups involves studying key indicators such as support, resistance, and trend. By examining these details, you can make well-informed trading decisions based on the data and market dynamics.

Why is understanding both OI Spurts and Volume Spurts important in trading?

OI Spurts and Volume Spurts are distinct indicators, but they both play a significant role in gauging market liquidity and momentum. By comprehending both, traders can gain a more comprehensive view of market conditions, enhancing their trading strategies.

Can OI Spurts predict whether a stock's price will rise or fall?

OI Spurts alone do not predict price movements. They indicate where momentum is building, which can be used to make trading decisions. To make accurate predictions, traders should consider other factors such as market trends, technical analysis, and option chain analysis.

What is the difference between OI Spurts and Volume Spurts?

OI Spurts focus on changes in open interest, while Volume Spurts track changes in trading volume. OI Spurts provide insights into market sentiment and potential price movements, while Volume Spurts indicate heightened market activity and interest from traders and investors.

How can I use OI Spurts to select stocks for day trading or swing trading?

OI Spurts can be a valuable tool for both day trading and swing trading. By identifying stocks with significant changes in open interest, traders can pinpoint potential opportunities for short-term or longer-term trades based on market momentum.

Are there any risks associated with the OI Spurts Strategy?

While OI Spurts can be an effective trading tool, they do not guarantee profits and can carry risks. It's essential for traders to consider various factors and conduct comprehensive analysis before making trading decisions to manage potential risks effectively.

No comments: