How to detect Option buyers and Seller on Option Chain

One of the most frequently asked questions is how to identify Option Buyers and Sellers on the Option Chain, which is no less than a challenging puzzle.

For a beginner in option trading, the data on the Option Chain can appear intricate and unfamiliar. Even experienced traders may find the data resembling a convoluted chain of random numbers. As a result, the Option Chain remains a popular topic of discussion among option traders.

Acquiring knowledge about the buyers and sellers can assist an option seller in minimizing losses and maximizing profits. Additionally, it enables the seller to promptly identify the need for making any necessary adjustments to their trades. Let's dive deeper to identify buyers and sellers on the Option Chain.

What is an Option Chain?

The Option Chain is a crucial table that contains essential information, such as Volume, Open Interest, Change in Open Interest, Premium, Change in Premium, and more, for both calls and puts for various strikes of an Index or Stock. This information can be valuable in making profitable decisions and avoiding the common mistakes made by option traders.

When it comes to the Option Chain, I believe that Open Interest and Change in Open Interest are the most vital pieces of information as they effectively convey the market sentiment if analyzed carefully. Please refer to the image below for a visual representation.

Take a look at the image showcasing the OI positions in the Nifty. The liquidity of the Nifty is indicated in this image, but how do we differentiate between sellers and buyers in the Open Interest? This is where it gets interesting!

For instance, let's consider the Nifty 9500 strike, which has 15 lakh call OI and 10 lakh Put OI. The question is, how many of them are call sellers and buyers? Unfortunately, we cannot determine the exact number of buyers and sellers, but we can still distinguish between buying and selling for a particular strike in a given period.

To do so, we need to combine the Change Open Interest data with the Change in Premium. This combination allows us to identify four trend cycles: Long, Short, Short Cover, and Unwinding.

Open Interest and Price Relationship for an Option

Open Interest

|

Price

|

Remarks

|

Increasing

|

Increasing

|

|

Increasing

|

Decreasing

|

|

Decreasing

|

Increasing

|

|

Decreasing

|

Decreasing

|

|

See the Option Chain of the Nifty,

Let's take a closer look at the Box and notice the OI change on the Call side. As you can see, all changes are positive, indicating that the call buyers hold the maximum chunk in the Open Interest.

On the other hand, if we observe the change in OI on the Put side in the box, along with their respective change in price, we can draw an interesting conclusion. Even though the change in OI is positive, the change in price is negative. This suggests that on those particular strikes, there is a big chunk of put writing.

So, what can we infer from this information? Well, it's important to pay close attention to both sides of the box and consider the interplay between OI and price changes.

This knowledge can help you make more informed trading decisions and potentially maximize your profits. You can make your master in Open Interest for Intraday for Nifty and Bank Nifty by analyzing these data closely.

Identify Buyers and Sellers at Coal India Option Chain

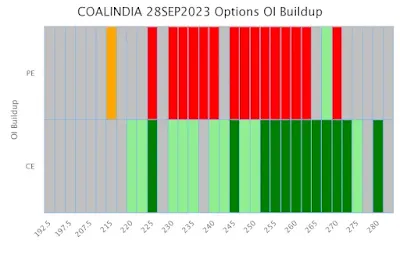

Below, you'll find a visual depiction of the Coal India Option Chain, which provides a clear way to discern those engaging in option buying and selling within the chain.To gain a comprehensive understanding, focus on two key colors: Red and Green bars. The Red bars signify the predominant presence of Option sellers among the various strike prices, while the Green bars represent the majority of Option Buyers.

Observing the call side, you'll notice a surge in call buying from strikes ranging between 250 to 275. Conversely, on the put side, strike prices spanning from 245 to 265 reveal a notable uptick in put writing activity within the option chain.

The Bottom Line

In conclusion, having a strong understanding of the Option Chain, including vital information such as Volume, Open Interest, Change in Open Interest, Premium, and Change in Premium, can help option traders make more informed decisions.

By combining data such as Open Interest and Price, traders can identify trend cycles, differentiate between buyers and sellers, and potentially maximize their profits. So, keep exploring and learning, and best of luck in your future option trading endeavors!

Some Frequently Asked Questions (FAQs)

What is an Option Chain, and why is it important for option traders?

An Option Chain is a critical tool that displays data on both call and put options for different strike prices. It includes information like Volume, Open Interest, Premium, and Change in Open Interest, which is crucial for making informed decisions in options trading.

How can Open Interest and Change in Open Interest help in understanding market sentiment?

Open Interest and its changes provide valuable insights into market sentiment. Increasing Open Interest can indicate option buying (Long Happening) while decreasing Open Interest can suggest option selling (Short Happening). But it needs to combine with price.

What are the key components to identify option buyers and sellers on the Option Chain?

To identify option buyers and sellers, traders should focus on combining Change in Open Interest with Change in Premium. This combination reveals four trend cycles: Long, Short, Short Covering, and Unwinding.

How can one interpret the interplay between Open Interest and Price changes on the Option Chain?

Analyzing the interplay between Open Interest and Price changes helps identify market trends. Positive changes in Open Interest and Price on the call side suggest call buying, while positive Open Interest changes but negative Price changes on the put side indicate put writing activity.

How can visual representations, like colored bars, aid in identifying option buyers and sellers on the Option Chain?

Visual representations using colors, such as green bars for buyers and red bars for sellers, make it easier to differentiate between those engaging in option buying and selling at different strike prices. You check the graphical representation on Opstra Option Tools.

It's important to pay attention to both the call and put sides of the Option Chain and consider the interplay between Open Interest and Price changes to make more informed trading decisions.

What is the significance of call and put side observations on the Option Chain?

It's important to pay attention to both the call and put sides of the Option Chain and consider the interplay between Open Interest and Price changes to make more informed trading decisions.

Can you provide examples of option chains, like the one shown for Coal India, to help identify buyers and sellers?

Yes, visual representations of option chains, like the one for Coal India, can provide a clear way to discern those engaging in option buying (green bars) and option selling (red bars) at different strike prices.

How can traders maximize their profits by using data like Open Interest and Price changes in the Option Chain?

By analyzing data like Open Interest and Price changes, traders can identify trend cycles, differentiate between buyers and sellers, and potentially make more profitable trading decisions.

What is the bottom line when it comes to using the Option Chain in options trading?

Understanding the Option Chain, including key data like Volume, Open Interest, Premium, and Price changes, is essential for option traders. It empowers them to make informed decisions and navigate the complexities of the options market.

Where can I find more resources and expert insights on Option trading using the Option Chain?

You can explore resources, books, and experts in the field of option trading to further enhance your knowledge and skills in using the Option Chain for trading.

Recommended Read:

No comments: