Unraveling the Magic of Delta Neutral Option Strategies

You've dived headfirst into the world of options trading, and you've probably heard the term delta-neutral thrown around a lot. But what on earth does it mean, and why should you care? Well, think of it as a magical spell to balance your risk and reward in the options world. In this section, we'll unravel the secrets of delta-neutral option strategies and why they're the Jedi mind tricks of the trading universe.

The Delta Dilemma: What's It All About?

Delta is your guiding star in the options galaxy. It's like a compass pointing you in the right direction, showing you how much your option's value will change for every point the underlying asset moves. If you're new to this, don't worry; you're not alone. Delta is often symbolized by a Greek letter (Δ), and it can range from 0 to 1 for call options and -1 to 0 for put options.

Deep in-the-money calls boast a delta of 1, while at-the-money call options sport a delta of 0.5. On the flip side, deep in-the-money put options carry a delta of -1, and at-the-money put options come with a delta of -0.5. Typically, out-of-the-money call options exhibit a delta below 0.5, and out-of-the-money put options tend to have a delta below -0.5. These delta values provide insights into the sensitivity of options prices to changes in the underlying asset's value.

Fun Fact: Future Contracts have delta 1.

Now, a delta-neutral strategy aims to balance the delta of your options positions. Why, you ask? Well, it's all about minimizing the impact of price movements in the underlying asset.

Check out the image where I hold two long positions, one in a call option with a delta of 0.84 and another in a put option with a delta of -0.75. The combined or net delta stands at 0.093. This indicates that the overall position has a limited exposure to price swings, providing a certain level of stability.

The Magic of Hedging

Delta-neutral strategies often involve hedging your positions. Imagine you've bought a call option on a hot stock, and you want to profit from its rise. However, you're not keen on suffering losses if the stock takes an unexpected nosedive. This is where delta-neutral magic comes in.

|

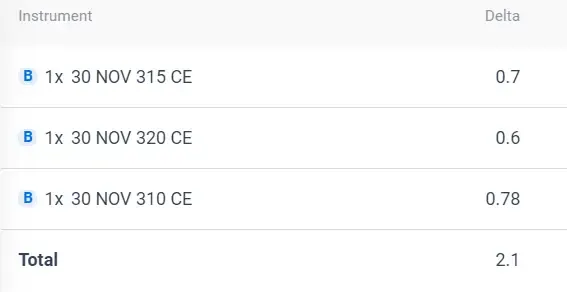

| Coal India Coal India Delta Neutral Position |

There are three call buying positions for Coal India Stock, each with strike prices of 310, 315, and 320. The corresponding deltas are 0.78, 0.7, and 0.6, resulting in a cumulative delta of 2.1. This signifies that if the price of Coal India increases by 1, the overall position is anticipated to move up by 2.1.

To create a delta-neutral hedge, you might short sell the stock or buy a put option. By doing this, you're essentially creating a safety net. If the stock goes up, your call option benefits, and any losses on the short or put option are offset. If the stock goes down, the put option or short position cushions the blow.

The Art of Straddles and Strangles

Let's put this into context with two famous delta-neutral strategies – the straddle and the strangle. These strategies are like the Batman and Robin of the options world.

Straddle: The Batman

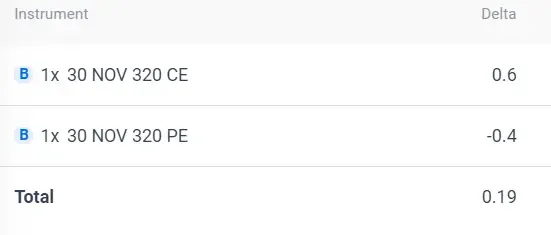

Picture Batman, the Dark Knight, patrolling Gotham City. He's always ready for action, no matter which way crime swings. A straddle is your Batman strategy. You buy a call option and a put option with the same strike price and expiration date. The call option profits if the stock goes up, and the put option profits if it goes down.

The trick here is that you're not betting on the direction; you're betting on movement. If the stock makes a big move in either direction, one of your options will likely offset the losses of the other, and you'll be in the green.

Strangle: The Robin

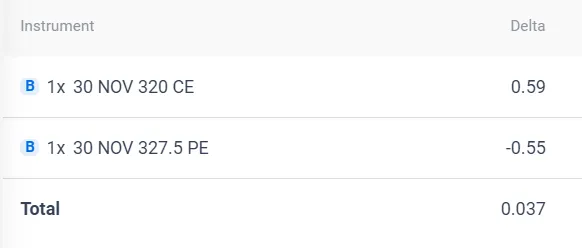

Now, let's meet Robin, Batman's trusty sidekick. A strangle is your Robin strategy. Like Batman, Robin is ready for action, but with a slight twist. In a strangle, you buy a call option and a put option, just like in a straddle, but here's the trick – the strike prices are different.

This strategy works when you anticipate a significant move in the stock but you're not sure in which direction. The call option profits if the stock goes up, and the put option profits if it goes down. It's a versatile strategy that allows you to benefit from volatility without betting on a specific direction.

The Balancing Act

So, why are straddles and strangles considered delta-neutral strategies? Well, it's all about that balancing act. When you purchase both a call and a put option, your net delta tends to be close to zero. This means that small price movements in the underlying asset won't have a significant impact on your overall position.

In essence, you're like a tightrope walker with a safety net. You're balancing on the rope, ready to adapt to any sudden gust of wind (or market volatility), and the safety net (your options) ensures you won't plummet to your doom.

When to Use Delta-Neutral Strategies

Now, you might be wondering when to whip out these delta-neutral tricks. Well, they're especially handy when you expect volatility but aren't sure about the market direction. Here are some scenarios where delta-neutral strategies shine:

- Earnings Reports: Before a company announces its earnings, the stock price can be quite unpredictable. Straddles and strangles can help you profit from the post-earnings price swing.

- Market Uncertainty: In turbulent times, like during economic crises or significant political events, delta-neutral strategies can help protect your investments.

- Event-Driven Volatility: If you're anticipating a significant event like a product launch, merger, or regulatory decision, delta-neutral strategies can be your go-to tool.

- Stock Breakouts: When a stock is on the verge of a major breakout, and you're not sure if it'll go up or down, delta-neutral strategies can capture the movement.

In each of these situations, delta-neutral strategies give you the flexibility to profit from market turbulence without taking a firm stance on price direction. It's like having your cake and eating it too.

Pros and Cons of Delta-Neutral Trading

So, you've mastered the art of delta-neutral trading, and you're ready to walk that fine line between risk and reward. But, before you embark on your delta-neutral adventures, let's talk about the pros and cons of this magical strategy. Like all good things in life, there are some upsides and downsides to delta-neutral trading, and we're here to break it down for you.

Pros: Turning the Spotlight on Delta-Neutral Brilliance

- Reduced Directional Risk: The most apparent advantage of delta-neutral trading is that you don't need to pick a side. You're not betting solely on whether an asset will go up or down. This strategy allows you to profit from price movements, regardless of their direction. It's like having a backup plan for all scenarios.

- Vega and Theta Play: Delta-neutral strategies often benefit from changes in implied volatility (vega) and time decay (theta). When volatility increases or time passes, your position can become more profitable. This flexibility makes it easier to adapt to changing market conditions.

- Consistent Income: Some delta-neutral strategies, like iron condors or calendar spreads, can generate consistent income. This can be appealing to traders looking for steady returns, much like receiving a monthly paycheck.

- Risk Management: Delta-neutral positions are often used for hedging. They can act as a safety net, protecting your investments during uncertain times. It's like having insurance for your portfolio.

Cons: Facing the Challenges of Balance

- Complexity: Delta-neutral trading can be complex, especially for beginners. It involves multiple options, and calculating and maintaining delta neutrality requires a good understanding of options and their Greeks.

- Costs: Delta-neutral strategies can be expensive. You may need to buy and sell multiple options, leading to higher transaction costs and potentially impacting your potential profit margins.

- Time Sensitivity: Some delta-neutral strategies are highly time-sensitive. If you're not vigilant, the time decay (theta) of your options can work against you, eroding your profits.

- Market Whipsaws: Rapid and unexpected market movements can challenge the effectiveness of delta-neutral strategies. Sharp price swings can result in adjustments and potential losses.

Delta-neutral trading is a bit like mastering a magic trick – it takes practice, patience, and a willingness to adapt. It's not for everyone, but for those who embrace its challenges and opportunities, it can be a powerful tool in the trading arsenal.

So, whether you're looking to reduce directional risk, harness vega and theta, generate consistent income, or manage your portfolio's risk, delta-neutral trading is a strategy worth exploring. Just remember to keep your balance, stay vigilant, and enjoy the magical ride of trading without being too tied to a single direction. After all, in the world of options, balance is key, and delta-neutral strategies help you achieve it with finesse.

Frequently Asked Questions (FAQs)

What is delta-neutral trading, and how does it work?

Delta-neutral trading is a strategy where you balance your options positions to minimize directional risk. It involves using a combination of options to create a position with a net delta close to zero. This means you can profit from price movements in the underlying asset without betting on the price's direction.

What are the advantages of delta-neutral trading?

Delta-neutral trading offers several benefits, including reduced directional risk, the potential to profit from changes in implied volatility (vega) and time decay (theta), the ability to generate consistent income, and effective risk management through hedging.

What are the challenges or drawbacks of delta-neutral trading?

Delta-neutral trading can be complex and may require a good understanding of options and their Greeks. It can also be costly due to the multiple options involved, and some strategies are highly time-sensitive, making them challenging to manage. Rapid market movements can impact the effectiveness of these strategies.

Who is delta-neutral trading suitable for?

Delta-neutral trading is best suited for traders and investors with a moderate to high risk tolerance who are willing to learn and manage complex strategies actively. It may be a good fit for those seeking steady income or looking to hedge their portfolios.

Can beginners engage in delta-neutral trading?

Delta-neutral trading is not typically recommended for beginners. It requires a solid understanding of options and their Greeks, making it more suitable for experienced traders. Beginners are encouraged to start with simpler strategies and gradually work their way up.

How can I learn more about delta-neutral trading?

To learn more about delta-neutral trading, you can explore educational resources, attend seminars or webinars, and consider reading books on options trading. It's essential to gain a thorough understanding of options and their Greeks before attempting these strategies.

Are there tools or software that can help with delta-neutral trading?

Yes, there are various options trading platforms and software tools that can assist with implementing and managing delta-neutral positions. These platforms often provide analytical tools to calculate and monitor your position's delta and other Greeks.

What are some common delta-neutral strategies?

Common delta-neutral strategies include the straddle, strangle, iron condor, and calendar spread. Each strategy has its own characteristics and is suitable for different market conditions and objectives.

How do I deal with changing market conditions when using delta-neutral strategies?

Managing delta-neutral positions involves regularly monitoring your position and adjusting the quantities of options to maintain delta neutrality. Market changes, such as shifts in implied volatility or rapid price movements, may require you to make timely adjustments.

Can delta-neutral trading guarantee profits?

No trading strategy, including delta-neutral trading, can guarantee profits. While these strategies offer advantages, there are no guarantees in the market. Success depends on your skills, market conditions, and the proper execution of your chosen strategy.

No comments: