Unveiling the Benefits of Writing Options

Today, we're diving headfirst into the thrilling world of options, and why being the writer – or seller – of options is like having a secret weapon in your financial arsenal. You'll soon discover that when it comes to options, the benefits of being on the selling side are too good to ignore. Finally We will unfold the benefits of call option writing.

What Are Options Anyway?

Options are like the secret sauce of the stock market. They're financial contracts that give you the right, but not the obligation, to buy or sell a stock at a predetermined price (the strike price) on or before a specified date (the expiration date). Picture it like reserving a table at a restaurant - you can choose to show up or not, depending on how hungry you are.

Two Flavors of Options: Calls and Puts

There are two main types of options: calls and puts. Calls are like a golden ticket to buy a stock at a specific price, while puts give you the power to sell at that same price. Think of them as your "Buy Low, Sell High" and "Sell High, Buy Low" cards in the stock market game.

Understanding the Option Writing

Now, when we say writing options, we're not talking about penning a bestseller. Writing options means you're the one selling these magical option contracts to others. Let's delve into why this strategy can be a game-changer for your investment portfolio.

Uptrends, Downtrends, and Sideways Markets

Picture the market as a wild rollercoaster, with steep climbs, thrilling drops, and sometimes, a peaceful plateau. It can move up (uptrend), down (downtrend), or go nowhere in particular (sideways). Most of the time, it enjoys a leisurely stroll or hangs out in a range.

Option Writers' Time to Shine - Benefits of Call Option Writing

Here's where the magic begins – when the market decides to chill in that range, sellers step into the spotlight. They're like the stars of the show during a market siesta. But don't get us wrong; sellers aren't limited to ranging markets, they're just most at home there.

The 65% Option Sweet Spot - The reason why write options

This is where it gets interesting. Around 65% of options expire worthless. You know who loves that? Option sellers! When options expire worthless, it's like money falling from the sky for sellers. Sweet, right?

The Seller's Advantage – Math at Its Best

When someone writes a call option, it typically indicates a bearish outlook on the market. Conversely, put writers are often seen as bullish in their stance. Interestingly, there's a 66% chance that option sellers will find themselves in the winning seat. Let's delve into how this plays out:

As mentioned earlier, the market can follow one of three trends: an uptrend, a downtrend, or a sideways movement.

For those who choose to write call options, they stand to profit in two out of three scenarios. For instance, if they've written a call and the market takes a bearish turn, their option will be profitable. Likewise, if the market remains stagnant and consolidates, they still make money due to the premium gradually eroding over time.

On the other hand, put sellers also enjoy favorable odds. They can profit in two out of three possible situations. If the market turns bullish, they're in the money. And in cases where the market consolidates, they stand to make money as well.

The only instance when option sellers face losses is when the market trend goes against their initial prediction.

Unlimited Risk, Limited Profit

As noted earlier, trends tend to work in favor of option writers. However, when trends move in the opposite direction, it can lead to substantial losses piling up. In this scenario, the profit remains limited, exactly equal to the premium received when the options were written. On the flip side, losses can escalate unpredictably, making it a risky endeavor.

Think of it as being the cautious one at the casino. Sure, you won't hit the jackpot, but you won't go broke either.

The Odd Man Out – Option Buyers

Now, let's talk about the buyers. They're the hopeful ones, the dreamers. But here's the catch: only about 33% of the time, they get to celebrate. The other 66%? Well, sellers are having the party.

Option Buyers Versus Option Writers

Options trading is often referred to as a zero-sum game because for every gain in options trading, there is an equal and corresponding loss. In a zero-sum game, the total gains and total losses among all participants sum to zero. Here's how it works in the context of options trading:

- Two Parties: In options trading, you have two primary participants - the option buyer and the option seller (writer).

- Profit and Loss: When an option buyer profits from a trade, it's because the option's value has increased, and they can sell it for more than they paid. On the other side, the option seller incurs a loss equal to the buyer's gain. The seller's loss is the buyer's gain, and these amounts offset each other.

- Premium Exchange: The option buyer pays a premium to the seller for the option contract. This premium is the maximum loss for the buyer, and it's the maximum profit for the seller. The premium remains within the system, circulating between buyers and sellers.

- Net Zero: When you consider the net result of all options trades in a given market or timeframe, the gains and losses among all participants balance out. In other words, for every rupee gained by an option buyer, a rupee is lost by an option seller, resulting in a net gain of zero across the entire market.

- Brokerage Fees: It's important to note that the brokerage fees and transaction costs can affect this balance slightly. These fees are typically paid to the brokerage firm and do not directly impact the gains and losses between buyers and sellers. However, they can influence the profitability of individual trades. Therefore, always choose a broker wisely.

Understanding the Balance

- When it comes to risk, option buyers face limited exposure, restricted to the premium paid. Conversely, option sellers encounter limited profit potential, confined to the premium they receive.

- While option buyers dream of unlimited profit potential, option sellers dance on the edge of unlimited risk.

- If an option buyer is raking in profits, it's a sign that the option seller is counting losses of the same amount.

- In the world of options, when an option buyer is facing losses of a certain amount, the option seller is simultaneously enjoying profits equal to that sum.

- Lastly, the option buyer's optimism about a market price increase is mirrored by the option seller's belief that the market will remain at or below the strike price, and vice versa.

Option Writing and the Associated Risks

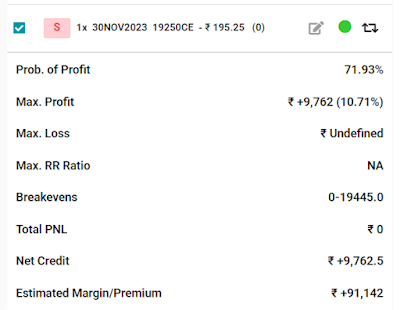

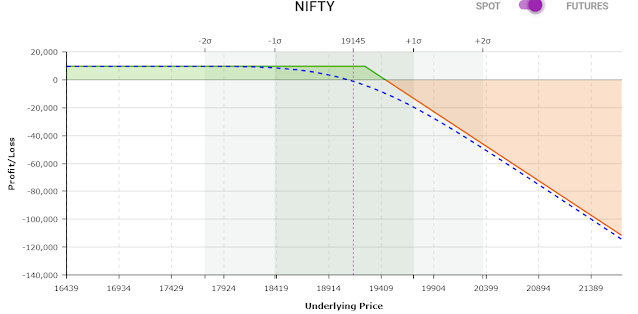

Let's break down a practical scenario. Imagine the Nifty future is currently trading at 19,145, and you, as the option seller, decide to sell a call option with a strike price of 19,250, which is being offered at a premium of Rs. 195.

Now, looking at the probability chart, you'll notice that your chance of making a profit stands at around 72%. The maximum profit you can achieve in this setup amounts to Rs. 9,762. This calculation takes into account the Nifty lot size of 50 and the premium of Rs. 195.

But here comes the twist - your maximum loss is not clearly defined; it's unlimited. That's the intriguing aspect of option selling. As long as the Nifty future stays below 19,445 at expiration, you're in the clear. However, once Nifty starts soaring past this level, the door to unlimited risk swings wide open.

For instance, if Nifty future expires around 19,600, you could be looking at a loss of approximately Rs. 23,000. And if Nifty continues to surge, crossing the 20,000 mark, your losses may escalate to around Rs. 27,000. The kicker is that these losses can keep growing as Nifty's future prices move higher.

In this real-life example, you can see that as a call seller, you have a 72% probability of reaping a profit, with the tantalizing prospect of gaining up to Rs. 9,762. However, it's essential to bear in mind that your potential losses are uncapped. So, when you're venturing into the world of option selling, be sure to do so with wisdom and a well-thought-out strategy.

Why Writing Options Rocks!

In a world of financial opportunities, writing options stands out as a strategy that offers unique benefits. Sure, it's not without its risks, but the odds are often in the seller's favor. With limited profit potential and the power of belief, sellers can find success in a market that's moving in multiple directions.

So, whether you're a seasoned investor or just starting your option trading, consider writing options as your secret financial weapon. It's a strategy that can add a dash of excitement to your portfolio and increase your chances of winning in the world of options. With the right approach, you can turn the tables and become a successful option seller. So, go ahead, explore the magic of writing options, and let your option trading journey take flight!

Frequently Asked Questions About Writing Options

What are options in the stock market, and how do they work?

Options are financial contracts that grant the holder the right (but not the obligation) to buy or sell a stock at a specified price on or before a specific date. They come in two main flavors: call options and put options.

What does it mean to "write options"?

Writing options means selling these option contracts to other investors. It's like being on the other side of the negotiation table, providing others with the right to buy or sell the stock.

Why is writing options often seen as a game-changer in investing?

When market conditions are relatively stable or moving in a range, option writers can capitalize on the time decay of options and the high probability of options expiring worthless, allowing them to profit consistently.

Can you explain the concept of limited risk and unlimited profit potential for option buyers and sellers?

Option buyers face limited risk, meaning they can lose at most the premium they paid for the option. Conversely, option sellers have limited profit potential, equal to the premium they received for selling the option. However, option sellers also have the potential for unlimited losses if the market moves strongly against their position.

Why is options trading often described as a zero-sum game?

Options trading is considered a zero-sum game because for every gain made by an option buyer, there is an equal and opposite loss experienced by an option seller. The total gains and losses among all participants balance out to zero.

What are some tips for writing options successfully?

- Choose stocks wisely, focusing on stable, well-established companies.

- Select option writing strategies that align with your risk tolerance and investment goals.

- Diversify your portfolio by writing options on different underlying assets.

What should investors be cautious about when writing options?

The key risk when writing options is the potential for unlimited losses if the market moves significantly against your position. It's crucial to manage your positions, use protective strategies like stop-loss orders, and have a clear exit plan.

What are the advantages of writing options, and how can it enhance an investment portfolio?

Writing options can offer regular income in the form of option premiums, even in relatively stable markets. It allows investors to profit from time decay and high probability of options expiring worthless, making it a valuable addition to an investment portfolio.

What's the best way to get started with writing options, and are there any recommended resources for learning more?

To start writing options, consider opening an options trading account with a reputable brokerage. It's essential to learn and understand the basics of options, including different strategies, before diving in. You can explore various online resources, attend webinars, or consult with a financial advisor to enhance your options knowledge.

How to monetize Volatility

Volatility Rank and Volatility Percentile

How to read Option data for trading

No comments: