Unleashing Open Interest, IV and OI Spurts for Trading

The Magic of Implied Volatility on Nifty

Have you ever wondered how some people seem to work their magic in the world of options trading, reaping rewards while managing risks? Well, it's time to let you in on a little secret - it's all about the correlation between Implied Volatility (IV) and the Nifty index.

In this article, we'll break down the fascinating relationship between Implied Volatility and Nifty, making it easy to grasp and hopefully, a bit fun too.

Cracking the Options Code

Options trading is like a treasure hunt. You're hunting for non-linear payoffs that can lead to limited risk and unlimited profits. But before you embark on this thrilling journey, it's crucial to understand how to navigate the labyrinth of options. That's where Open Interest (OI) and Implied Volatility (IV) come into play.

Options: The Basics

Options have these things called variables: option types, time to expire, strike prices, and underlying values. Imagine these as the puzzle pieces that make up your trading strategy. The catch is that these pieces aren't static; they keep shifting and changing.

Meet the Option Greeks

Now, let's take a closer look at our four musketeers - Delta, Gamma, Theta, and Vega, collectively known as the Option Greeks. They're like your sidekicks, helping you make sense of this options adventure.

- Delta is your compass, tracking the direction of change.

- Gamma is like turbo boost, accelerating Delta's power.

- Theta measures the time value, reminding you that time is money.

- Vega records the rollercoaster of volatility, and its effects on the premium.

The Implication of Volatility

Volatility is like the spice of options trading. Sometimes it's super spicy, and other times, it's mild. Implied Volatility (IV) is your tool to measure this spice level. It's like adding cayenne pepper to your financial stew.

The Mystery of Expensive Options

Have you ever noticed that some options are like luxury cars, super expensive even though they're not quite in the money? This is where Implied Volatility (IV) steps in.

When option premiums skyrocket without the underlying price or expiry changing much, it's like a mystery unfolding. High IV is often seen before significant events, like election results or earnings reports.

And as soon as these events are over, the market usually chills out, and so do the premiums. But in our current times, there's a big elephant in the room - the pandemic, causing the highest volatility levels.

Calculating IV

IV is calculated using four main ingredients: underlying value, strike price, time to expiry, and risk-free rate. When IV is high, premiums follow suit. When IV is low, premiums take a siesta.

But here's the twist: calculating and interpreting IV for multiple stocks can be as tricky as solving a Rubik's Cube blindfolded. So, don't fret; we've got a handy index called the India VIX to give you the inside scoop on the market's current volatility status.

The Art of Reading Implied Volatility - Correlation between IV and Nifty

Now, why should you care about IV? Well, because it's your secret weapon in predicting the tops and bottoms of stocks or indices. Picture this: India VIX is above 80, and Nifty is taking a nosedive below 8000. This is like a neon sign flashing "bottom's up!" When the VIX starts to cool down, it's often the first sign that the market is getting ready for a turnaround.

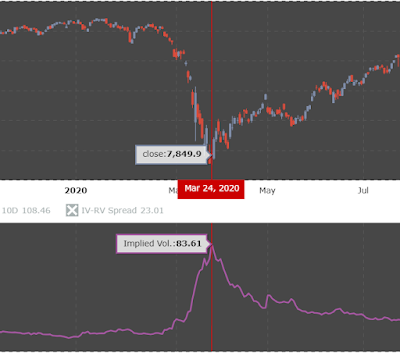

Behold the striking visual depicting the historic interplay of Implied Volatility (IV) and Nifty. On the fateful 23rd and 24th of March 2020, IV soared beyond 80, coinciding with Nifty's dramatic nosedive.

Since that pivotal moment, IV has been gradually cooling down, a trend unmistakably traced in the graph above. Simultaneously, observe Nifty's graph ascending during this time frame. It's a beautiful synergy wherein IV adeptly reflects market bottoms.

Open Interest - The Plot Thickens

Let's move on to another player in this grand options opera - Open Interest (OI). It's like the script that's readily available on the NSE website and option chains. By the way, don't worry if you've never heard of it before; we're here to demystify it.

Cracking the OI Code

Open Interest is all about spotting patterns in the distribution of open contracts across various strike prices. Now, don't let this scare you; it's like looking for Easter eggs in a field, only you're hunting for profitable insights.

Understanding OI Spurts

Imagine you're at a stadium watching your favorite team. OI Spurts are like the roar of the crowd when something big happens. If you see a significant change in premium without the underlying price and expiry budging, you can thank OI Spurts for the excitement.

Reading the Tea Leaves: Interpreting OI

Now, you've gathered the data. What's next? It's time to interpret it, and this is where the magic truly happens.

- Trading Range: Think of this as your playground, sandwiched between the highest call strike and the highest put strike. This is where the action often takes place.

- Highest Resistance: This is like the heavyweight champion in a boxing match. The heaviest call open interest often works as the highest resistance for the index.

- Highest Support: On the flip side, the heaviest put open interest acts as the strongest support for the index. It's like the trampoline that keeps the market from falling too low.

- Pivot Strike: This strike is where the bulls and bears meet for a tug of war. When a stock breaks free from this range, you're in for a rollercoaster ride.

Embracing the Magic

Now that you've got a comprehensive understanding of the correlation between Implied Volatility and Nifty, you're ready to work some magic of your own in the world of options trading. These insights are just the tip of the iceberg, but they can make a world of difference when combined with your existing trading techniques.

Whether you're into options, cash trading, or futures, understanding the correlation between IV and Nifty will be your guiding star on your journey to financial success.

Share Your Secrets:

So, do you use data analytics in your trading endeavors? We'd love to hear your stories and experiences about the correlation between Implied Volatility and Nifty. Share your wisdom in the comments below.

And remember, before you jump into the world of option data analytics, make sure you have a solid understanding of these concepts. After all, a little knowledge can go a long way in the realm of options trading.

Note:It's important to note that this analysis serves an educational purpose. As a responsible trader, it is advisable to conduct your independent analysis or seek guidance from a financial advisor before making any investment decisions.

How to use Volatility effectively

How to select option strike for buying

Frequently Asked Questions related to Implied Volatility (IV)

What is Implied Volatility (IV), and how does it relate to Nifty?

Implied Volatility (IV) measures the expected volatility of a security's price. Its relation to Nifty is that changes in IV can impact Nifty's option prices and market sentiment.

Why is understanding the correlation between IV and Nifty important for traders?

Understanding this correlation helps traders gauge market sentiment, make informed options trading decisions, and anticipate potential price movements in the Nifty index.

How can I calculate Implied Volatility for Nifty and other stocks?

IV is typically calculated using option pricing models, but you can find real-time IV data for Nifty and stocks from financial data providers.

What is the India VIX, and how is it used to gauge market volatility?

The India VIX is a volatility index that measures expected market volatility. It's used to assess Nifty's volatility and help traders anticipate market movements.

How does high Implied Volatility impact Nifty's performance?

High IV can result in higher option premiums and increased market uncertainty, potentially leading to more significant price swings in Nifty.

Can you provide examples of past events where IV had a significant impact on Nifty?

Events like economic crises, elections, or corporate earnings releases can lead to spikes in IV, impacting Nifty's options pricing and performance.

Are there specific trading strategies that take advantage of the IV-Nifty correlation?

Yes, various strategies use IV and Nifty correlation for options trading, such as straddles or strangles.

What is Open Interest (OI), and how does it relate to Nifty along with IV?

Open Interest represents open contracts in options. It's related to Nifty and IV as changes in OI can provide insights into market sentiment and potential price movements.

How can traders use the information about IV and Nifty correlation to make better investment decisions?

Traders can make more informed decisions, adjust their strategies, and manage risk by monitoring IV and its relationship with Nifty.

What are the potential risks and challenges associated with trading based on IV-Nifty correlation?

Risks include misinterpretation of data and market volatility. Challenges may include accurate prediction and timing of market movements.

Is it advisable for beginners to consider the IV-Nifty correlation in their trading decisions?

Beginners should start with a solid understanding of basic concepts before diving into complex correlations. It's advisable to gain experience gradually.

How do I interpret the graphs and charts depicting the historical relationship between IV and Nifty?

Pay attention to trends and correlations in the data. When IV and Nifty move together or diverge, it can offer insights into market sentiment and potential price movements.

forex tradingThank you very much

ReplyDelete