Nifty and Bank Nifty Analysis for 6th July 2020

Nifty opened on a mildly positive note on Friday and stayed in the positive territory for the entire session. However, without signalling any directional trend, the index kept on moving back and forth in a 60-point range.

Let’s check the data and do the analysis for Bank Nifty and Nifty for 6th July 2020 based on Open Interest, Change in OI, PCR, Max pain and Trend Cycles.

Bank Nifty Option Front

Bank Nifty has given closing at 21852.40 on spot on 3rd July 2020. On the options front, maximum Put open interest was at 21,000 followed by 20,500 levels, while maximum Call OI was at 23,000 followed by 22,500 levels. The OI positions are scattered at various strike rates, indicates the volatility can remain in the market. A good put addition has been seen around the ATM strike.

Trading Range Of Bank Nifty

Now time to find out the trading range of the bank nifty. Trading Range is a general range between the highest call strike and highest put strike. To find the range, we need to look for the highest call OI Row and Highest Put OI Row on the option chain of the Bank Nifty. Trading range seems to be 21000 to 23000.

1. Highest Call at 23,000.

2. Highest Put at 21,000.

3. Pivot Level at 22,000.

Highest call acts as the highest resistance and highest put acts as the highest support for the Nifty and bank nifty. Pivot level is the level that bulls and bears don’t want to let it go easily. Tug of the war goes around the pivot level between bulls and bears generally.

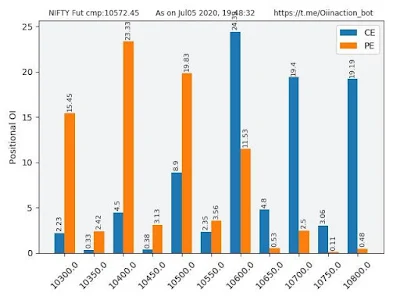

Trading Range Of Nifty

Nifty has given closing at 10607.35 at spot on 3rd July, 2020. In options front, maximum Put open interest stood at 10,400 level followed by 10,000, while maximum Call OI was at 11,000 followed by 10,600 levels. Call addition was seen at 10,600 followed by 10,700 levels, while there was meaningful Put writing at 10,500 followed by 10,400 levels. Options data suggested a shift in trading range between 10,400 and 10,700 levels.

1. Highest Call at 11000.

2. Highest Put at 10,400.

3. Pivot Level at 10,600.

3. Pivot Level at 10,600.

India Vix

India VIX fell 2.80 per cent from 26.51 to 25.76 levels on Friday. A gradual decline in volatility, which is falling since the last three consecutive weeks, and is at the lowest level in four months, suggests an overall bullish stance. A lower VIX with an overall rising Put-Call ratio suggests the emergence of multiple supports, leading to buy on any intraday decline strategies in the market.

It is sustaining above the maximum on Box Plot into outlier data on the daily scale and thus volatile swings may continue in the coming days. If you wonder what Box Plot is and how it works, you can check here details.

Derivative Data

Symbol

|

Pre. Max Pain

|

PCR (OI)

| |

Bank Nifty

|

22000

|

22000

|

0.78

|

Nifty

|

10500

|

10550

|

1.5

|

Remarks

| |||

Trend Cycles (EOD)

| Bank Nifty Trend Cycles |

| Nifty Trend Cycles |

Conclusion

The writers have been shifted their position up, indicates the strength in indices. Put writers are at the driving sheet as of now. Max Pain strike has been shifted up that also support the bullish sentiment. The OI on option chain indicates range-bound to little bullish sentiment.

Open Interest Images are generated by the Telegram Bot: OIinAction. You can also join it and can generate OI images for free.

Disclaimer: The analysis has been prepared for informational and educational purposes only. It is not and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Recommended Read:

No comments: