What is long unwinding or Long liquidation?

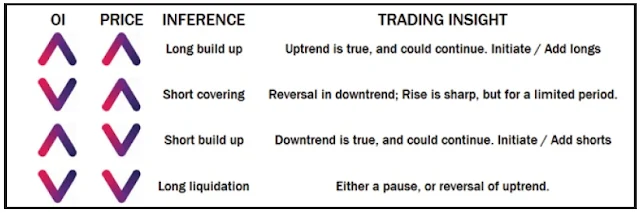

Long unwinding: Fall in price with fall in OI

Unwind means offloading or selling a position. In trading parlance, long unwinding refers to selling of positions or stocks owned for a long period either to book profit or to exit it in anticipation of impending bearishness. Long unwinding usually happens when traders feel the price of a stock or security is nearing its point of resistance, or the bullish view on it has reached a certain saturation point.

|

| Trend Cycles |

Let's understand it with an example:

Say a share X was trading at Rs. 100. You bought this as you believed that some up move is due in upcoming days.

Finally, That rally comes, Now share X started trading around 180. This level is resistance for the share and believe the rally may pause here. And share may start consolidating around or profit booking may come on it.

You decided that not to continue with the share which may consolidate around. So you sold the shares that you are holding and booked your profit. What you did you simply closed the long position.

So unwinding can be defined as the closing of a long position.

How to identify it

When long unwinding happens in a share or market, Price of share of index falls and Open Interest of the share falls as well. This shows mild weakness in the share. It does not mean you go short heavily on share, but it means the closing the long positions. It may bring a reversal in uptrend.

This YouTube video may help you in the understanding the concept in depth.

No comments: