HDFC Bank Option Chain Analysis for This expiry

The financial world is abuzz with news of an impending merger between HDFC Bank and HDFC, a development that could soon catapult the institution into the ranks of the world's largest banks. Excitement surrounds this potential union, prompting us to delve into the depths of HDFC Bank's option chain, shedding light on the fascinating dynamics and opportunities unfolding within.

Join us as we explore the intricacies of this remarkable institution and dissect the current state of its option chain, providing insights into the future of this potential banking powerhouse.

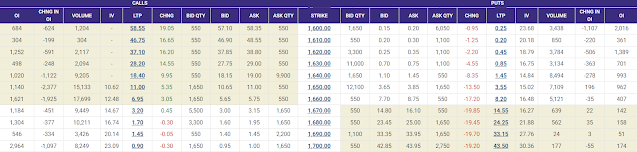

HDFC Bank Option Front

On June 27, 2025, HDFC Bank concluded the day's trading session at a closing price of 1628.25. Notably, the option chain analysis reveals intriguing patterns. The highest open interest on the call side resides at the 1700 strike price, witnessing a substantial 2964 lots of option contracts being written. Conversely, the highest open interest on the put side is found at the 1600 strike, with 2016 lots of contracts written. Additionally, interestingly, there has been some unwinding observed at the 1650 and 1660 strike prices on the call side.

Trading Range of HDFC Bank

Let us now turn our attention toward determining the trading range of HDFC Bank. To accomplish this, our focus shifts to identifying the highest call open interest (OI) row and the highest put open interest (OI) row within HDFC Bank's option chain. By examining these crucial data points, we can unveil valuable insights into the potential trading range of this esteemed financial institution.

1. Highest Call at 1700

2. Hghest Put at 1600

3. Pivot Strike at 1650

4. Trading Range 1600-1700

PCR and Max Pain

The max of standing at 1630 and PCR is 0.71. These are neutral.

Option Chain OI Build UPs

OI Build Ups on Option chain are as follow:

Conclusion:

HDFC Bank currently finds itself at a critical juncture, as it hovers around a pivotal level. The significance of the 1650 mark cannot be overstated, as it serves as the make-or-break point for the bank's trajectory. Should HDFC Bank manage to sustain its position above 1650, the potential for substantial upside becomes apparent. Conversely, a failure to hold firm at this level may trigger profit booking and lead to a decline towards the vicinity of 1600. Presently, the bank seems to be confined within a narrow trading range, signaling a period of consolidation. However, for a notable movement to materialize in either direction, HDFC Bank must successfully break free from this tight range.

No comments: